With the pending acquisition of 2051 Veronica St, Pittsburgh, PA we are glad to present this asset to our partners as an investment with an attractive rate of return.

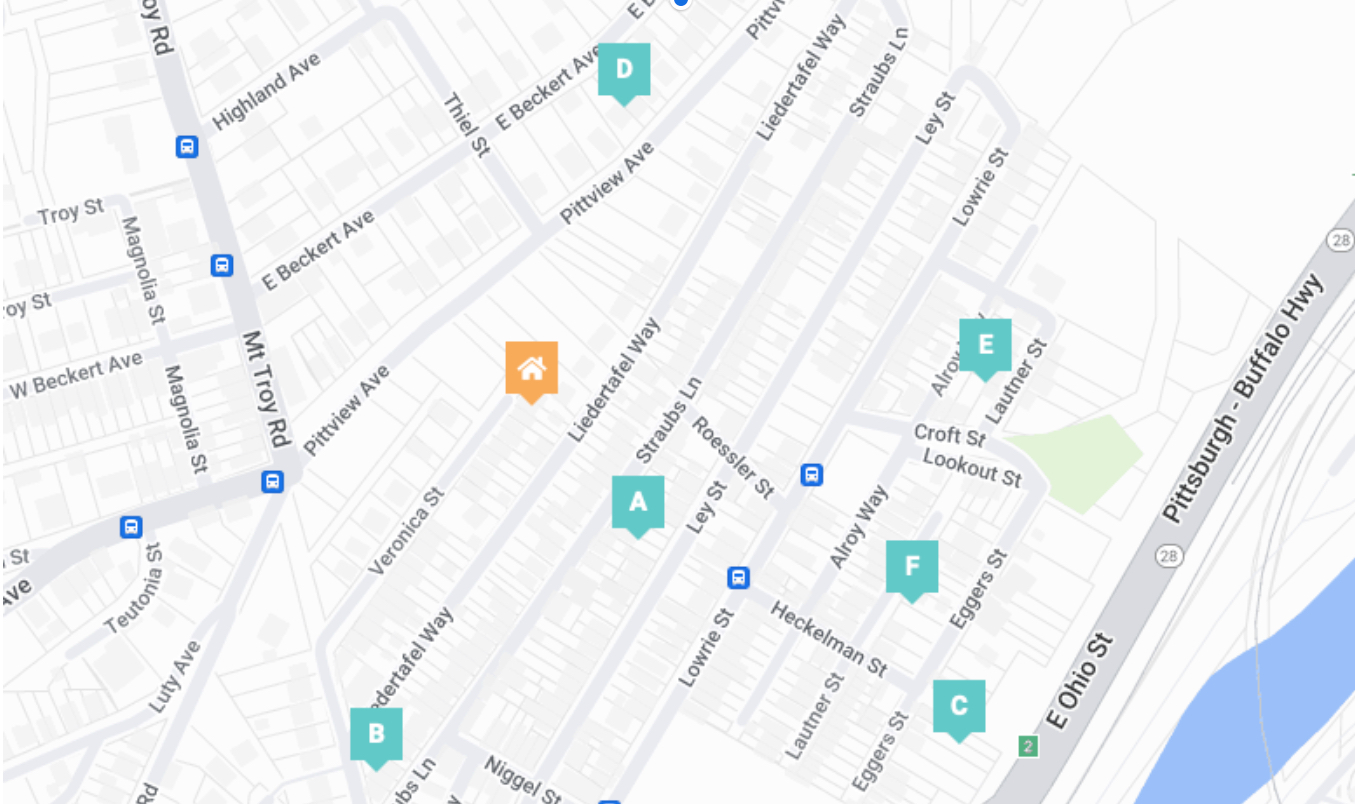

Located in the Troy Hill neighborhood of Pittsburgh, this property is in a residential suburb in the outskirts of downtown Pittsburgh less than 3 miles to the North Shore amenities like Acrisure Stadium, PNC Park, and multiple shopping and commercial districts. It’s also conveniently located just across the river from Pittsburgh’s Strip District and universities including the University of Pittsburgh, Carnegie Mellon, Point Park University, and several other colleges. The median price in the area for similar homes is approximately $240,000 and properties are being sold as standard sales within 51 days on the market, with hot properties selling in just 34 days on average and at 3% above list price.

We are in-contract to purchase this property at a cost of $85,000 with an after-repair value (ARV) of $229,000.

It needs approximately $60,000 worth of rehab, which will include finishing the kitchen remodel, finishing plumbing for the downstairs bathroom, drywall and painting in several rooms, finishes throughout, some exterior landscaping, and new kitchen appliances. We estimate a 3-month timeline for completion of rehab and 3 month disposition of the property for a total project timeline of 5 months.

This property has a close date on or before Friday, November 20, 2023.

We’re seeking an investment of $30,000 with two options for return including a debt option at 25% interest, or an equity option at 25% equity. Investment option details and returns are included in this document.

Thank you for your consideration.